Inheritance Advances are still not that well-known, so there are misconceptions surrounding them, but hopefully, this guide will provide some clarification. The frustrating, tedious, and lengthy process of probate is the reason so many people look into getting an inheritance advance

What is Probate?

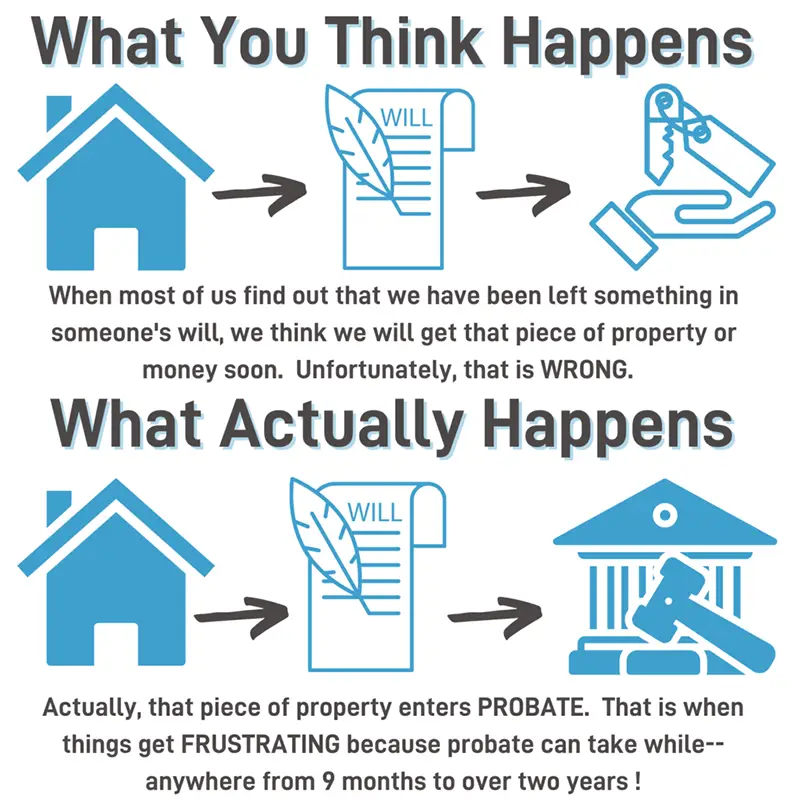

Probate is the legal process by which property owned by a deceased person is passed to his or her heirs after the death. In other words, Probate is simply passing the title or determining who gets what when someone passes away, either by looking at the Will or if none exists, then under the laws of intestacy, essentially the rules that determine the hierarchy of heirs. Probate affords the overall management and supervision of the distribution of the deceased person’s assets by the instructions left in a Will or in keeping with the state’s statutes (if a Will does not exist or cannot be located).

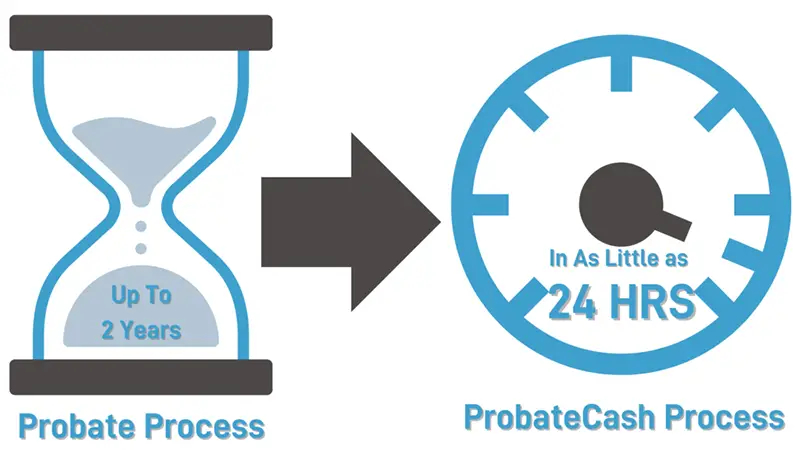

So many people get overwhelmed and frustrated by probate because of how LONG it takes. The probate process can take anywhere from 9 months to over two years. Probate can drag on for even longer, sometimes taking several years, depending upon the complexity of the estate, the number of heirs, and the speed of the local court administering the case. Many issues affect the probate time frame – for example, the size of the estate, locating beneficiaries listed in the Will, validating the Will, any litigation in regards to the Will, and appointing an executor to the estate if there is no Will to refer to.

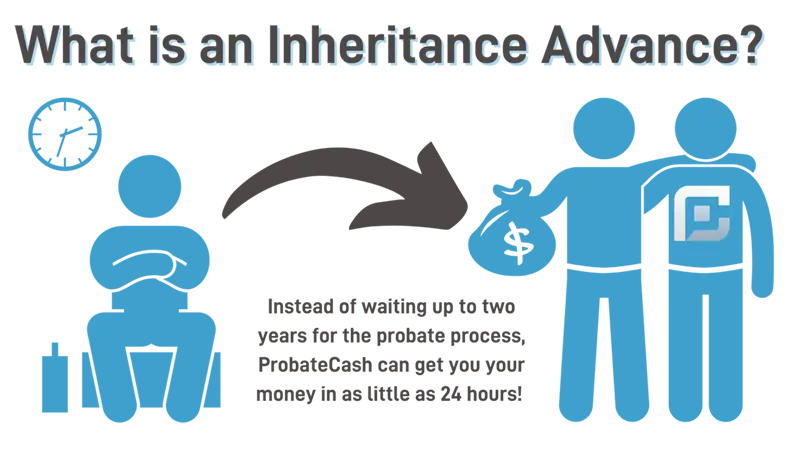

So, you can imagine that waiting up to two years for your inheritance money could be a problem for heirs. Sometimes heirs need that money in a shorter time frame, which is when an inheritance advance is a good solution. For some, delayed inheritance payouts and a lack of cash can make it harder to sell estate property. Without money to fund routine home maintenance or relocate those still living on the property, there can be intense pressure to sell the family home for less than fair market value to get the estate closed and the creditors paid. Imagine you inherit a house, and you want to sell it, but the real estate agent tells you the only way of getting the most for your money is to make repairs. You were not expecting to inherit a house, let alone make costly home repairs, so what do you do? Sell the house and know you did not get fair market value? Wait till probate settles, which could be two years! Instead of waiting up to two years, some people decide to get an inheritance advance.

ProbateCash offers inheritance advances SAME DAY. So instead of waiting up to two years, people get their money in as little as 24 hours!

There’s also the cost of probate. Probate expenses usually run anywhere from 3% to 7% of the estate’s total value. This includes court costs, executor’s fees, possible expenses, a surety bond, appraisal fees, and legal and accounting fees. If there is a “Will contest,” the cost can run even higher.

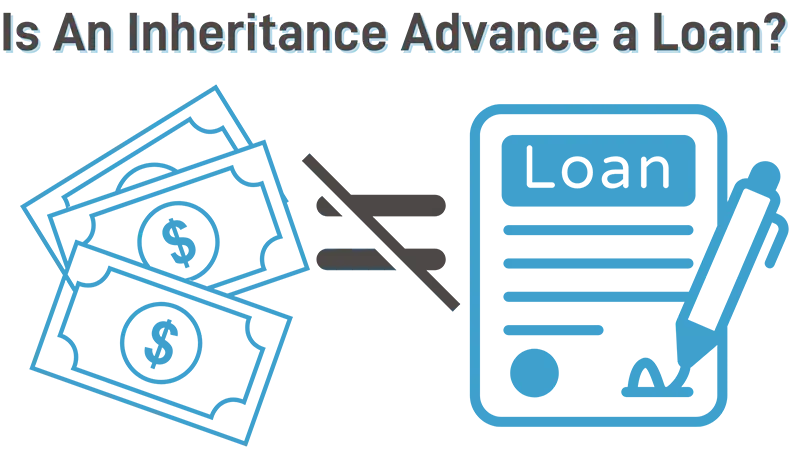

So now that we covered how probate works, let’s break down inheritance advances a bit more. Probably the biggest misconceptions about inheritance advances are this one question.

Although often called inheritance advance loans, inheritance advances are not loans. Unlike a loan, an inheritance cash advance has: no interest fees, no fixed “due date,” and imposes no personal recourse or liability in a payment shortfall. You are NOT liable for any shortfall or deficiency, with a few exceptions such as fraud, etc. Eligibility and approval aren’t dependent on your credit score or income; an inheritance cash advance is the fastest and easiest way to receive and use a portion of your inheritance money right away. Check out ProbateCash’s CEO Marc Harris explaining why an inheritance advance is not a loan.

What is an Inheritance Advance?

Ok, so if it’s not a loan, what is an Inheritance Advance? We talked about how long the probate process takes. So, you could probably guess by now that an inheritance advance or probate cash advance provides upfront cash to the heirs/beneficiaries of estates waiting for inheritance money in probate court. Essentially, it is exactly what it sounds like, an advance on your pending inheritance.

ProbateCash allows the customer to receive an immediate inheritance advance -on their expected inheritance, with advances available from $5,000.00 to $500,000.00. ProbateCash will file the cash advance with the probate court and will be paid when the estate makes a distribution.

Is an Inheritance Advance Right for You?

Now that you know an inheritance advance is not an inheritance advance loan or any loan for that matter, the big question remains, is an Inheritance Advance Right for You? Getting an inheritance advance is a big decision, and it is not for everyone, but for some people, an advance on inheritance can indeed be life-changing.

Need to prep estate property for sale? To recap what we covered earlier, this may be a solution to cover HOA fees, make repairs or relocate heirs remaining on the property.

Sometimes getting an inheritance advance is not about maintaining a home but other financial burdens. Pay your bills. Fix up your own home or car. Unplanned medical expenses or upcoming tuition. Unfortunately, because the courts are so hopelessly backlogged, many things can come up while you are waiting for your inheritance. Inheritance Advances can be used for whatever is best for you. There is no requirement to use it to benefit the estate. Your money now, for your needs.

If you are waiting for your inheritance, you have decided that you need an inheritance advance; you might wonder where you can even get an inheritance advance.

Here at ProbateCash, we pride ourselves on being the best inheritance advance company. When you need your money, we know you need it fast, so we get you your cash in as little as 24 hours!

Once you decide to get an inheritance advance, the most important thing is to make sure to get an inheritance advance from an honest, reliable company. When reading all of the inheritance advance reviews, ProbateCash stands out as one of the best inheritance advance companies for FOUR main reasons.

- FAST. Time is of the essence in funding inheritance advances. We are always ready to jump in with the resources and experience to fund any size advance as quickly as SAME DAY!

- PROFESSIONAL. Our people are professionals with decades of experience providing upfront cash to customers who don’t want to wait years to receive the monies due to them.

- HONEST. We keep our promises. At ProbateCash, there are never any hidden fees. We want our customers to feel comfortable working with us and confident knowing exactly what to expect.

- RISK-FREE. You are NOT liable for any shortfall or deficiency. Eligibility and approval aren’t dependent on your credit score or income. Bottom line, an inheritance cash advance is the fastest and easiest way for you to receive and use a portion of your inheritance money right away, without taking out a loan.

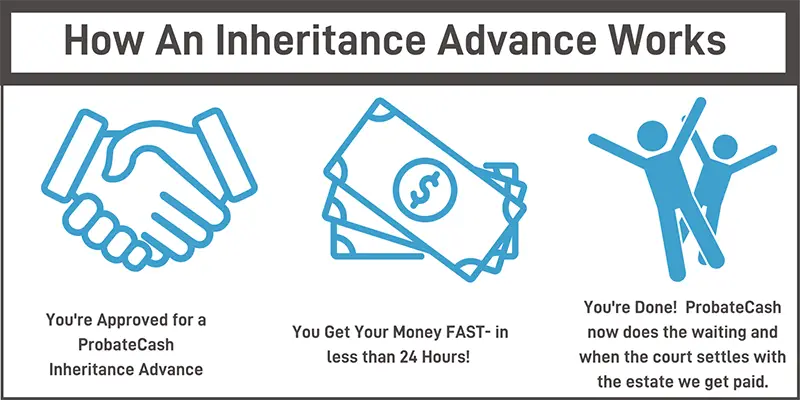

But wait, this is all great information, but how do inheritance advances actually work?

Choosing the right inheritance advance company is super important because it affects another common question. Everyone wants to know how much an inheritance advance costs, and that depends because inheritance advance companies have different inheritance advance fees. Of course, here at ProbateCash, we pride ourselves on being the best inheritance advance company. Call us today for your quote and your specific inheritance advance fee.

You might also wonder how we get paid at ProbateCash. So once your inheritance advance is approved, you will get your money in as little as 24 hours. Then we handle the rest. We now do the waiting, and when the court settles with the estate, we get paid. We review the probate case filed in the courts and quickly determine the amount of money we can advance. ProbateCash takes the risk and waits out the time until the estate’s assets are ordered to be distributed by the probate court. ProbateCash will file the cash advance with the probate court, and ProbateCash will be paid when the estate makes a distribution. The Personal Representative/Executor/Administrator will make the distribution of the assignment to ProbateCash, and pay any remaining money owed to the heir as per the Court Order. So, generally speaking, you will not have to be the one to figure out how or to whom the payment should be made. Once again, our CEO, Marc Harris, explains this process.

Now that we understand how everyone gets paid, let’s get down to the bottom line.

How much money can you get in an inheritance advance?

ProbateCash can provide an inheritance advance anywhere from $5,000 to $500,000 if the situation warrants it. ProbateCash will do our best to confirm the size of the estate, number of heirs, number of creditors, and the size of claims and will quickly assess the current market value of any property being sold, as well as which court is supervising the probate case and the status of any court proceeding. If you are interested in inheritance advancement, contact us today. Karen Iturrino, our VP of Business Development, explains the rule of thumb regarding the amount we generally advance.

Understandably, dealing with inheritances will tend to be family issues, so you might be concerned about how getting an inheritance advance affects the other heirs. You might also wonder what happens if the beneficiary assigns more money than they will receive? Will it hurt the other heirs’ share? No. Simply put, the fact that one beneficiary agrees to receive an inheritance advance from us will have NO adverse effect on the estate, the estate’s other beneficiaries, or even the probate lawyer for the estate. Other beneficiaries will still receive whatever they were entitled to, provided the estate has the money to pay them at the end of Probate. ProbateCash’s CEO, Marc Harris, alleviates these concerns in the below clip.

And we have already talked about this, but it is always good to reinforce how quick you can get in your advancement. Time is of the essence in funding inheritance advances. We are always ready to jump in with the resources and experience to fund any size advance as quickly as SAME DAY! Karen Iturrino, our VP of Business Development, speaks about how quickly you can get an advancement. We understand that there might be no more important factor in an inheritance advance than SPEED!

Even though speed might be your biggest concern, we understand you might still have other questions. We always try to make the process as simple as possible. Let’s discuss Qualifying for an Inheritance Advancement.

How do I qualify for an Inheritance Advancement?

The first benchmark in qualifying for an inheritance advance is establishing that you are an heir in an open probate case or the beneficiary to a trust. After you do that, it’s a pretty simple and straightforward process. Eligibility and approval aren’t dependent on your credit score or income. An inheritance cash advance is the fastest and easiest way for you to receive and use a portion of your inheritance money right away, without taking out a loan. All you need is to give ProbateCash a call.

Does the estate have to have cash assets?

No. In many instances, real property is the estate’s significant asset, which leads heirs to pursue an inheritance advance. We can work with estates selling real property and offer you an immediate inheritance cash advance in the interim. Our VP of Business Development, Karen Iturrino, explains why you don’t need cash assets.

Can I qualify for an Inheritance Advancement with Bad credit?

Yes, you can still qualify even if your credit is less than stellar because credit is not a requirement for approval. Get your money risk-free with no credit checks! The process will move faster if you have the following documentation for the inheritance advance.

So let’s ensure you have everything you need for a quick inheritance advance before applying! Below is the requested documentation for the inheritance advance.

- Petition for Probate,

- Will (if applicable),

- Order for Probate,

- License/ID/passport,

- Proof of social security number

- estate inventory (if available).

Getting an Inheritance Advance

If you now think that an inheritance cash advance is right for you, ProbateCash would love to help you! We could start working for you right away and prove why our clients continually rate us the best inheritance advance company. Let’s get started on getting you an advance on your inheritance in as little as 24 hours!

Learn more about inheritance Advances in your state. here.